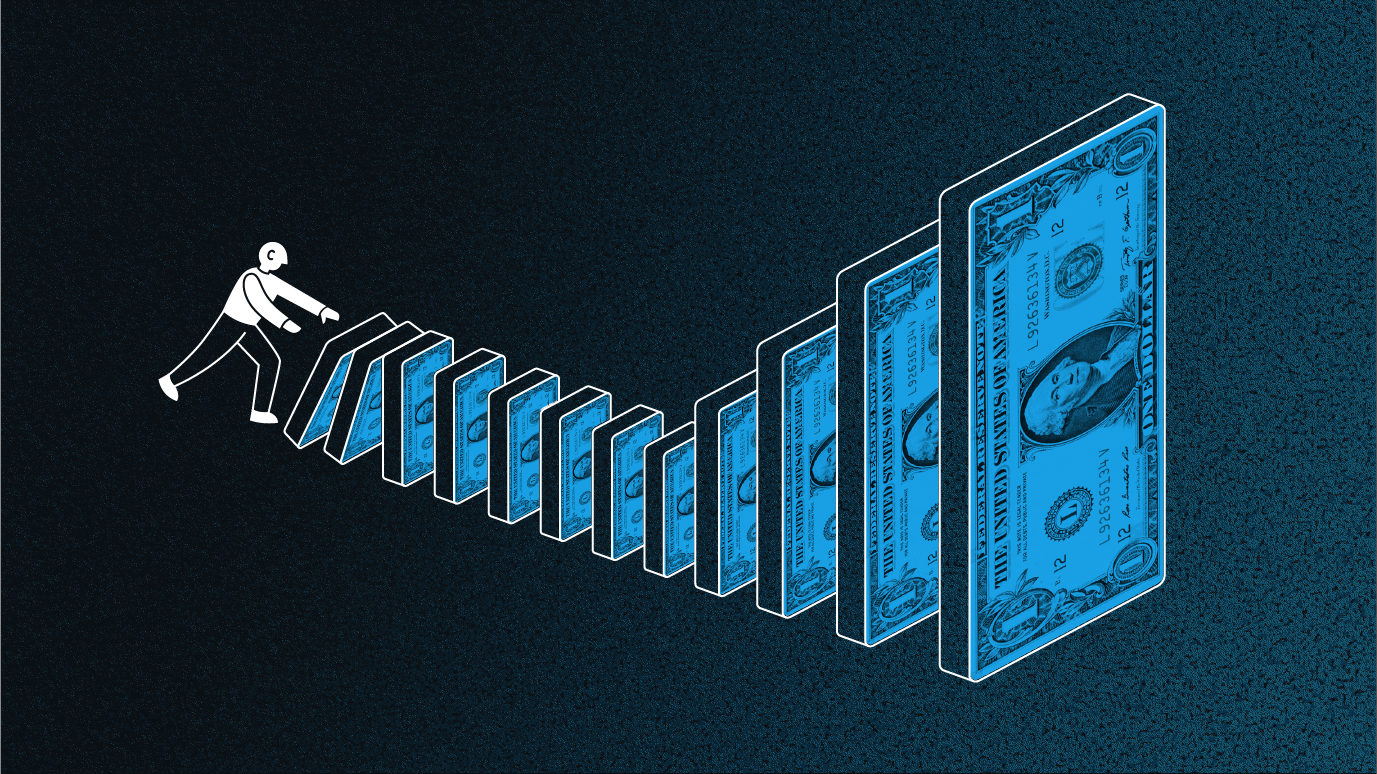

Compound interest is often referred to as one of the most powerful concepts in finance, and for good reason. Whether you’re saving for retirement, a home, or just looking to grow your wealth, understanding compound interest is essential for making the most of your savings. It’s not just about earning interest on your initial deposit, but also about earning interest on the interest you’ve already accumulated. This compounding effect can significantly increase your savings over time.

In this article, we will explore how compound interest works, why it’s so important for saving, and how you can leverage it to achieve your financial goals.

1. What is Compound Interest?

At its core, compound interest refers to the process of earning interest on both your initial investment (the principal) and the interest that has already been added to that investment. In contrast, simple interest is calculated only on the principal amount.

To better understand this, let’s break it down:

- Principal: The initial amount of money you invest or save.

- Interest: The cost of borrowing money (for loans) or the return you earn on your savings (for investments).

- Compounding: The process by which the interest you earn is added to the principal, so that the next interest calculation is based on the new total.

In other words, compound interest means your money is working for you, earning returns on both the original amount you invested and the accumulated interest from previous periods.

Example of Compound Interest

Let’s consider a simple example:

- You invest $1,000 at an interest rate of 5% per year.

- After one year, you will earn $50 in interest (5% of $1,000).

- After the second year, you will earn interest not only on your original $1,000 but also on the $50 interest from the first year. So, you’ll earn $52.50 in the second year (5% of $1,050).

- Over time, this cycle repeats, and the interest you earn continues to increase as the amount on which the interest is calculated grows.

The formula for compound interest is: A=P(1+rn)ntA = P left(1 + frac{r}{n}right)^{nt}

Where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial money).

- r is the annual interest rate (decimal).

- n is the number of times that interest is compounded per year.

- t is the time the money is invested or borrowed for, in years.

2. How Does Compound Interest Grow Over Time?

The power of compound interest is most evident when it is allowed to work over a long period. The longer the time frame and the more frequent the compounding, the greater the growth.

The Effect of Time on Compound Interest

The key factor that makes compound interest so powerful is time. The longer your money has to grow, the more interest you’ll earn. Here’s why:

- Exponential Growth: Because interest is earned on both the principal and the accumulated interest, the growth becomes exponential over time.

- The Rule of 72: A popular rule of thumb for estimating how long it will take for an investment to double at a given interest rate is the Rule of 72. You divide 72 by the interest rate (in percentage form). For example, at an interest rate of 6%, it would take approximately 12 years for your money to double (72 ÷ 6 = 12).

Example of Time’s Impact on Compound Interest

Consider two people who both invest $5,000 at 6% annual interest. One invests for 10 years, and the other invests for 30 years.

- Person A (10 years):

Using the compound interest formula, after 10 years, their investment grows to approximately $8,974.

This means they earned $3,974 in interest. - Person B (30 years):

After 30 years, their investment grows to approximately $28,425.

This means they earned $23,425 in interest.

As you can see, the investment that was left to compound for 30 years grows far more than the one compounded for just 10 years. The key takeaway is that time is one of the most important factors when it comes to maximizing the benefits of compound interest.

3. The Frequency of Compounding

Another factor that affects the power of compound interest is how often the interest is compounded. The more frequently interest is compounded, the greater the amount of interest you will earn.

Types of Compounding

- Annual Compounding: Interest is calculated and added once a year.

- Semi-Annual Compounding: Interest is calculated and added twice a year.

- Quarterly Compounding: Interest is calculated and added four times a year.

- Monthly Compounding: Interest is calculated and added twelve times a year.

- Daily Compounding: Interest is calculated and added every day.

The more frequently interest is compounded, the more times interest is applied to the growing balance, which results in faster growth. In fact, even if the interest rate is the same, an account that compounds interest more frequently will end up with a larger balance than one that compounds interest less frequently.

Example: Comparing Annual vs. Monthly Compounding

Let’s say you have $1,000 at an interest rate of 6% for one year.

- Annual Compounding:

After one year, you’ll have $1,060 (6% of $1,000). - Monthly Compounding:

If the interest is compounded monthly, the formula adjusts slightly to account for monthly compounding, and you’ll have about $1,061.68 at the end of the year (slightly more than with annual compounding).

Though the difference in this example is small, over many years, the cumulative effect of more frequent compounding can significantly increase the final amount.

4. Why Is Compound Interest Important for Saving?

The importance of compound interest in saving cannot be overstated. It’s a tool that allows your savings to grow faster and more effectively, helping you build wealth over time. Whether you are saving for retirement, a down payment on a house, or simply building an emergency fund, compound interest offers a significant advantage.

Benefits of Compound Interest for Saving

- Maximizes Your Savings: Compound interest allows you to earn money on the interest you’ve already accumulated. This leads to exponential growth, making it a great tool for long-term wealth building.

- Works Even Without Additional Contributions: If you are consistently saving and reinvesting interest, you will see your savings grow without needing to make large, additional contributions.

- Benefits from Early Saving: The earlier you start saving, the more time your money has to compound and grow. Starting early is one of the best ways to take full advantage of compound interest.

- Retirement Savings: Compound interest is especially powerful for long-term savings like retirement. Even small contributions made consistently over time can grow into significant amounts by the time you retire.

Example: The Power of Starting Early

Let’s compare two individuals: One starts saving $5,000 per year at the age of 25, and the other starts saving the same amount per year at the age of 35. Both save until they turn 65, and the annual interest rate is 7%.

- Person A (starts at 25):

If Person A saves $5,000 per year for 40 years, they will have approximately $1,100,000 at age 65. - Person B (starts at 35):

If Person B saves the same $5,000 per year but only for 30 years, they will have approximately $500,000 at age 65.

As you can see, by starting early, Person A ends up with more than double the amount saved, thanks to the additional 10 years of compounding.

5. How Can You Use Compound Interest to Your Advantage?

Understanding compound interest is just the first step. To truly make it work for you, here are a few strategies to maximize its benefits:

- Start Saving Early: The earlier you start, the more time your money has to grow. Even small contributions can add up over time.

- Make Regular Contributions: Contributing regularly (e.g., monthly or annually) helps your savings grow faster.

- Reinvest Your Interest: Always reinvest the interest you earn. This allows your money to keep growing, creating a compounding effect.

- Choose High-Interest Savings Accounts: Look for savings accounts, investments, or retirement plans that offer high interest rates, which can significantly boost your savings over time.

- Be Patient: Compound interest works best over long periods. Resist the temptation to withdraw interest, and instead let it grow.

Conclusion

Compound interest is a powerful force in the world of personal finance. By earning interest on both your principal and the interest you’ve already earned, compound interest allows your money to grow exponentially over time. Whether you’re saving for retirement, an emergency fund, or a big purchase, understanding and utilizing compound interest can significantly enhance your financial goals.

The key to benefiting from compound interest is to start as early as possible, make regular contributions, and let your savings grow over time. The longer your money has to compound, the more wealth you can build, turning small, consistent efforts into significant financial results.